Do you analyse your data & have useful KPIs? Are your cost centres under control.

Do you know how your business compares?

Thousands of managers, agencies and tech businesses are working hard to protect their lifestyles and businesses. The Covid pandemic highlighted the need for a strong balance sheet, reserves and a flexible operating model. The professionalization and investments in this sector have meant that more companies realise their exit potential and need to address their business’s financial and efficiency metrics.

Some companies barely break even, yet some are the same size and enjoy a 20% EBITDA. What is the difference between the two, how do they operate, where are the cost centres, etc? We have participating managers already and all information is kept strictly confidential. Only anonymised comparative results will be published.

Sign up to receive more information on how to get involved.

We have been asked numerous times what the best business model is. Full management or agency and subcontract? Whether to be OTA reliant and marketing staff lean? What is the expected EBITA for a successful company? What are the comparatives per discipline or company function?

The STR industry is global, fragmented and fraught with technical, staff, legislative and marketing challenges. We are undertaking research to reveal what metrics and KPIs are the most beneficial to work on, and where the leakage and major cost centres are. We only require a small amount of information initially and it will be anonymised.

Identifying the core KPIs and operating efficiencies will highlight how to ensure a solid future. All results will be shared with the participants, and a summary will be published.

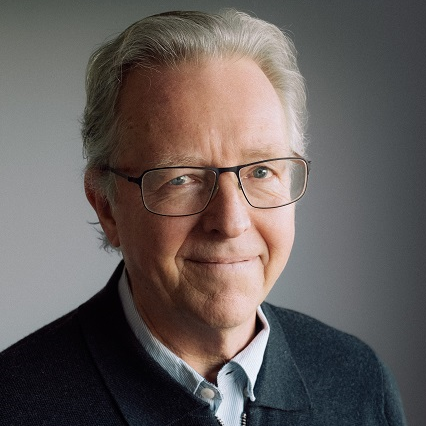

Richard Vaughton

Having established and exited two management businesses and an STR tech company, it has become abundantly clear that each short-term rental business is a microcosm, existing under its own independent KPIs and operating mechanisms. These companies have nearly always grown from a seed beginning.

Having been involved in startups, corporate roles and 21 exits, it is clear that the industry needs standards and comparative measures. We are starting this conversation across small, medium and large management businesses.

Please feel free to hookup through LinkedIn